jOMEGA - Best choice on banking solution

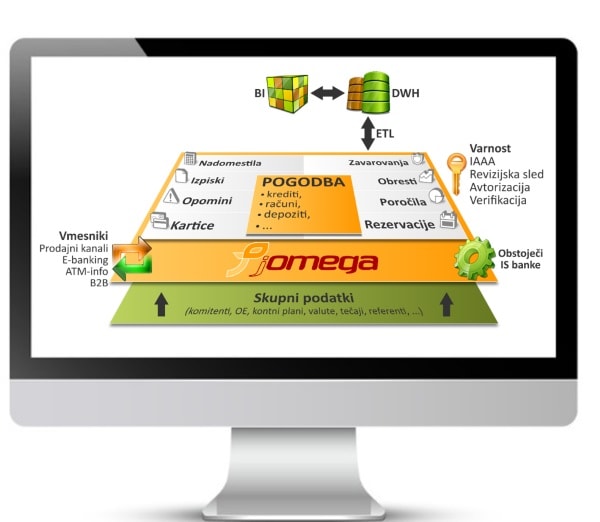

jOMEGA the modern technology based information system designed to automate and accelerate business transactions in the field of banking and financial institutions.

High parameterisation meets the high demands of modern business in the banking industry and enables agile adaptation to market conditions.

Developing new functionality is fully adapted to the client's wishes, which enables better organization and increased employee efficiency while satisfying the legal requirements of central banks.

The rapid development of new banking products and time save with adapting are just two of the great advantages of the information system jOMEGA.

jOmega has been ranked at GARTNER scale of core banking solutions

jOMEGA features

Comprehensive ERP solution (analysis, development, introduction, training, and maintenance).

Supports the entire process of business for legal and individual persons.

Enables the rapid development and implementation of new banking products.

Rapid integration into the existing IT structure.

Development with the latest technologies and databases (JAVA EE, Oracle, DB2).

Technical specifications

jOMEGA is developed with modern technologies and standards on JAVA EE . It is made by using Oracle ADF (Application Development Framework).

Used technologies:

- Java EE application server (Oracle Weblogic Server)

- Oracle ADF (Oracle Application Development Framework)

- EJB 3.0 – Enterprise Java Beans

- ADF Faces, Web 2.0 (View)

- ADF Bindings (Controller)

- ADF BC – ADF Business Components (Model)

- Relational database (Oracle, DB2)

Always be on the right track with jOMEGA

- Focused on the business logic

- Solid integration with the environment

- System modularity

- High level parametrization on the user side

- Assured security and compatible with regulations

- Established relational databases (ORACLE, DB2)

- Well-known and modern JAVA EE technology

- Integration of jOMEGA in individual sections (security module) or in full, into the existing IT structure of the client

- Developing new functionality is fully adapted to the wishes and needs of the client

- Guaranteed quality and reliable Service Desk available 24/7

Modules

LOANS TO INDIVIDUALS

The module is designed for the granting, benefits, monitoring and management of all types of loans to indivituals. It supports automated approval of bridging and fast loans based on parameters that define the boundary conditions. The flexible way of generating contracts, amendments, notifications and reminders is enabled, based on a system of patterns and widgets, which are managed by the client.

The module supports the following features:

- informational calculations and general information

- granting, utilization and management of credit

- changes in credit conditions

- daily processing

- monthly processing

- special procedures

- reminder procedure

- making printouts and reports

- manual bookkeeping of transactions

COLLATERALS

The module enables the management and monitoring of collaterals, which the bank accepts as collateral of their placements. Software support enables daily and monthly monitoring and evaluation of all forms of insurance (such as monitoring of changing value of the pledged securities) and generate the appropriate alerts when the value of the collateral is closer to the maximum limit, which still provides an adequate guarantee bank placement.

COLLATERALS

The module enables the management and monitoring of collaterals, which the bank accepts as collateral of their placements. Software support enables daily and monthly monitoring and evaluation of all forms of insurance (such as monitoring of changing value of the pledged securities) and generate the appropriate alerts when the value of the collateral is closer to the maximum limit, which still provides an adequate guarantee bank placement.

MULTICURRENCY TRANSACTIONAL ACCOUNTS

Module supports transactional operation with individual avista account in local currency and any other number of foreign currencies.

Implemented complete standard functionalities:

- Management of inflows, outflows

- Issuing and redeeming checks

- Recording all other transactions

- Interest calculations

- Management balance of the account in domestic currency (Positive balance, Allowed negative balance (within the approved credit limit), Tampering with a negative balance)

Functionalities:

- Add, edit (change) and view access to contracts

- Account termination – Saldation

- EOD, EOM batches, including regular postings, outstanding claims of unauthorized debit balance

- Making printouts and reports

Full process automatization:

- Granting limits (application, collaterals, booking liabilities)

- Ordering payment cards

- Reporting to Sisbon (limits, loans, payment cards)

- Reminders (mass update, individual)

SAVINGS

Support for the management of saving contracts allows the opening and management of saving contracts in national currency and ensure the implementation of the following functions:

- Entry - opening , modifying, maintaining and closing saving contracts

- Daily processing

- Monthly treatment

- Creating printouts and reports

Basic features of the module:

- Defined minimum number of units for duration of savings

- The period of notice (announcement of payment of a certain number of days before payment)

- Announcement of partial or full payment in line with the calculation of interest

SAVINGS

Support for the management of saving contracts allows the opening and management of saving contracts in national currency and ensure the implementation of the following functions:

- Entry - opening , modifying, maintaining and closing saving contracts

- Daily processing

- Monthly treatment

- Creating printouts and reports

Basic features of the module:

- Defined minimum number of units for duration of savings

- The period of notice (announcement of payment of a certain number of days before payment)

- Announcement of partial or full payment in line with the calculation of interest